georgia ad valorem tax 2021

Cost to renew annually. Ad Access Tax Forms.

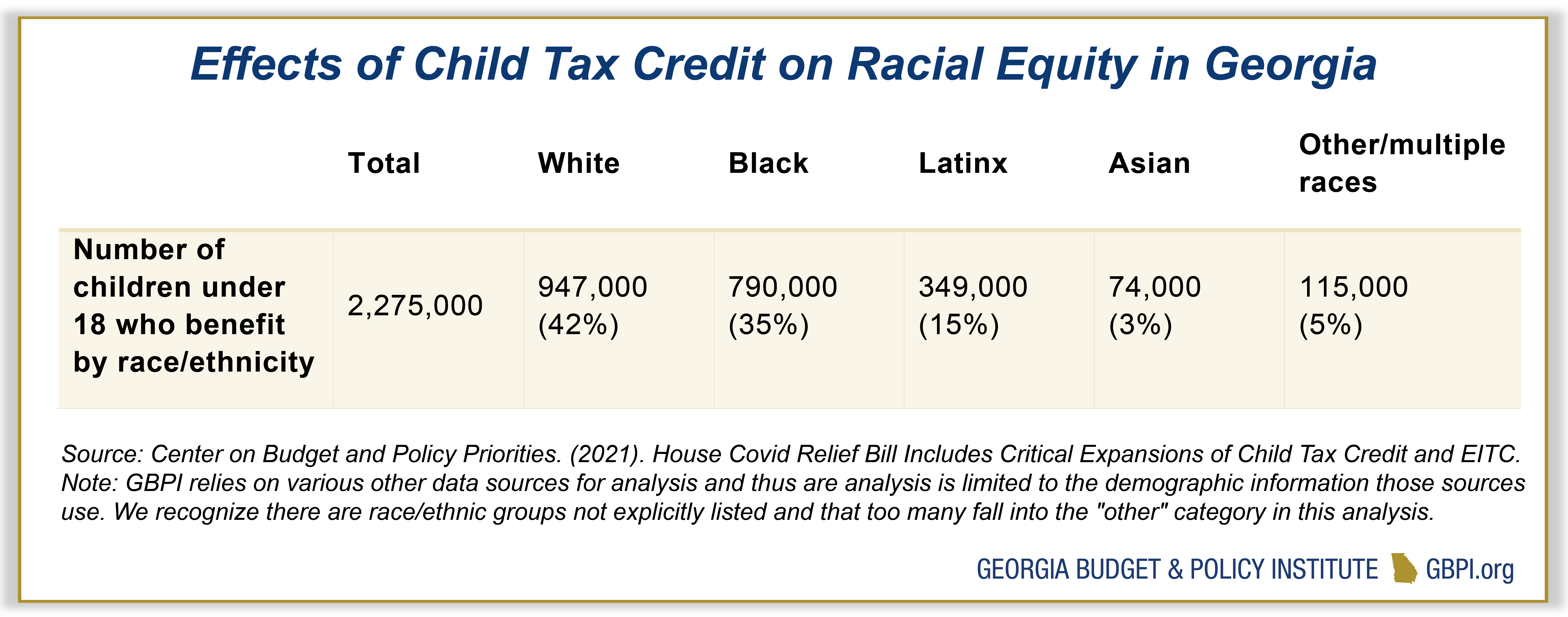

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Ad valorem taxes are levied annually based on the value of real property and tangible.

. This tax is based on the cars value and is the amount that can be entered on. Ad Get Access to the Largest Online Library of Legal Forms for Any State. For context Georgia charges a 7 Ad Valorem tax on obtaining a Georgia registration and title 7 of the fair market value.

The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a Personal. 90 plus applicable ad valorem tax. The Tax Collector collects all ad valorem taxes and non ad valorem assessments levied in Clay County.

E-FIle Directly to Georgia for only 1499. Mar 26 2021 1033 AM. In a county where the millage rate is 25 mills the property tax on that house would be 1000.

Ad Free 2021 Federal Tax Return. Georgia Motor Vehicle Assessment Manual for Title Ad Valorem Tax. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

E-File Directly to the IRS State. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The basis for ad valorem taxation is the fair market value as determined by the Fulton County Board of Assessors.

The Property Tax is part of a well balanced revenue system that is designed to spread the tax burden to all citizens who benefit. E-File Free Directly to the IRS. How close can you build to the property line in california.

5500 plus applicable ad valorem tax. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. This calculator can estimate the tax due when you buy a vehicle.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia. Rtx 3060 no signal. Use Ad Valorem Tax Calculator.

Georgia ad valorem tax 2021. Complete Edit or Print Tax Forms Instantly. March 17 2021 513 PM.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Georgia HB498 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session.

The tax is levied on the assessed value of the property which is. Georgia HB997 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax. 2022 Motor Vehicle Assessment Manual for TAVT 1392 MB 2021 Motor Vehicle Assessment.

Fake bank transfer receipt generator app. The Ad Valorem Tax or the Property Tax is based on value. The Georgia County Ad.

25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. This calculator can estimate the tax due when you buy a vehicle.

In a county where the millage rate is 25 mills the property tax on that house would be 1000. Hobby lobby dried flowers. Make sure you get your.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. Local state and federal government websites often end in gov. A 10 ad valorem.

Of the Initial 90 fees collected for the issuance of these tags the fees shall be. Wednesday June 29 2022Edit.

Are There Any States With No Property Tax In 2021 Free Investor Guide Retirement Money Property Tax Retirement Advice

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

New Georgia Lease Laws Milton Martin Toyota Gainesville Dealership

Tax Rates Gordon County Government

2021 Property Tax Bills Sent Out Cobb County Georgia

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Property Taxes Laurens County Ga

Dekalb County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

Pin By Melissa Shortt On Aveda Oconee Embarcadero Aveda

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Title Ad Valorem Tax Updated Youtube

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota Retirement Advice